What are Loan Guarantee Funds?

Community-lenders, often low-to-moderate income themselves, make unsecured loans to kin, friends, and neighbors at risk to their own personal financial well-being.

This risk is especially acute for Black and Latinx households who tend to have materially poorer networks than Whites. About a tenth of the Black-White racial wealth gap is attributable to Blacks providing financial assistance to lower-income members of their social networks.

Unlike mainstream finance, community finance is generally not capitalized or derisked.

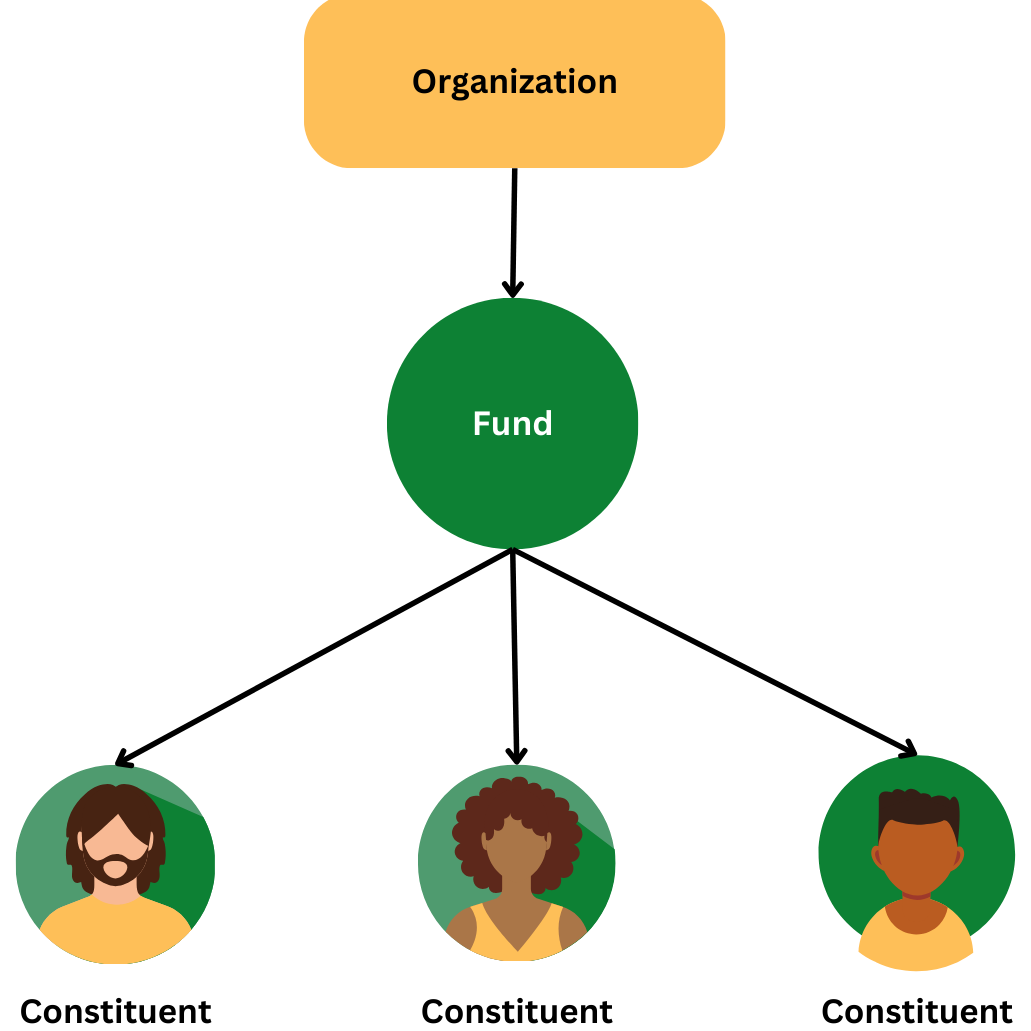

Giving Credit is solving for this by leveraging a variety of Funds to capitalize peer-to-peer lending.

Fund Types

Loan Guarantee Fund

Protect lenders

Cosign Fund

Protect borrowers

Association Fund

Protect borrowers and lenders in an association

-

Loan Guarantee Funds protect peer-lenders against loan loss. A loan guarantee fund leverages leverages capital in communities while uplifting local decision making and social underwriting.

How it Works:

Extend loan guarantee credit to a constituent with a specific amount (for example, $500).

The constituent lends to others in their network.

If a borrower defaults, the lender can claim reimbursement up to the loan guarantee limit.

Benefits:

Protect lenders against loan loss

Increase willingness to lend

Increase loan amounts

-

A cosign fund protects peer lenders making loans to a specific borrower. The fund provides a cosign credit to the borrower. This, in turn, helps the borrowers get loans from their social networks.

How this works:

The Fund extends a Cosign Credit to a constituent with a specific amount (for example, $500).

The constituent borrows from their social credit network or peer lenders.

The peer lenders are covered up to the Cosign Credit limit if the borrower defaults.

Benefits:

Protect lenders against loan loss

Increase willingness to lend

Increase loan amounts

Repair trust between borrowers and lenders

-

An association fund insures loans between lenders and borrowers who are within an association.

How this works:

The partner adds all members of the association to your fund on your partner administrative page on Giving Credit.

Members in the association make loans to one another. They can also make loans to others outside of the association but within their social credit network.

The association fund insures all loans between members in the association up to a limit.

Benefits:

Protect lenders against loan loss

Increase willingness to lend

Increase loan amounts

Create and manage a fund

Partner organizations use Giving Credit to support community finance in their constituencies by extending loan loss protection.

As organizations extend loan guarantees to peer lenders, peer lenders give credit to people in their networks, who in turn give credit to others, growing the social credit network.

Partner organizations can create and manage their fund through Giving Credit’s partner administrative page.