PARTNER WITH US

Character-Based Credit Reporting

By partnering with Giving Credit, you can help communities build a character-based credit report and expand their access to low-cost, wealth-building financial products and services.

PARTNERSHIP OPPORTUNITIES

Data Reporting

Do you have character-based or loan data on your clients and members? If so, you can start reporting that data directly to Giving Credit. We offer revenue sharing for data reporters.

Growth Partnerships

Invite your community to join Giving Credit through a co-branded landing page and customizable marketing materials. You can get started right away at no cost to you or your clients. Peer loans can now be part of their credit history!

FINANCIAL INSTITUTIONS

Underwriting Partnership

Financial institutions struggle to serve low-income individuals because they are missing critical credit data. The Giving Credit Report can help you better assess the credit risk of consumers and help provide high-quality, low-cost financial products to meet their financial needs. Starting at just $5,000/year or priced per report access.

Lead Generation

Receive loan application leads from Giving Credit users who are looking for low-cost, values-aligned loans. Access the Giving Credit Report to augment your current underwriting process.

Second Look Underwriting

Send applicants who fell right outside of your credit risk thresholds to Giving Credit. They will document their community finance activities and build a Giving Credit Report. Use the report to give the application a ‘second look.” Together, we can increase access.

PARTNERSHIP OPPORTUNITIES

Fund Partnerships

Partner organizations can create funds on Giving Credit to reward the peer lending of their members and community. Through a fund partnership, you will drive further capital into the social credit networks, accelerating the community lending and borrowing power. We offer three different types of fund partnerships starting at $2,500/year:

Loan Loss Insurance Fund

Provide a loan loss guarantee to peer-lenders to provide protection against default, so they support their community and protect their financial assets.

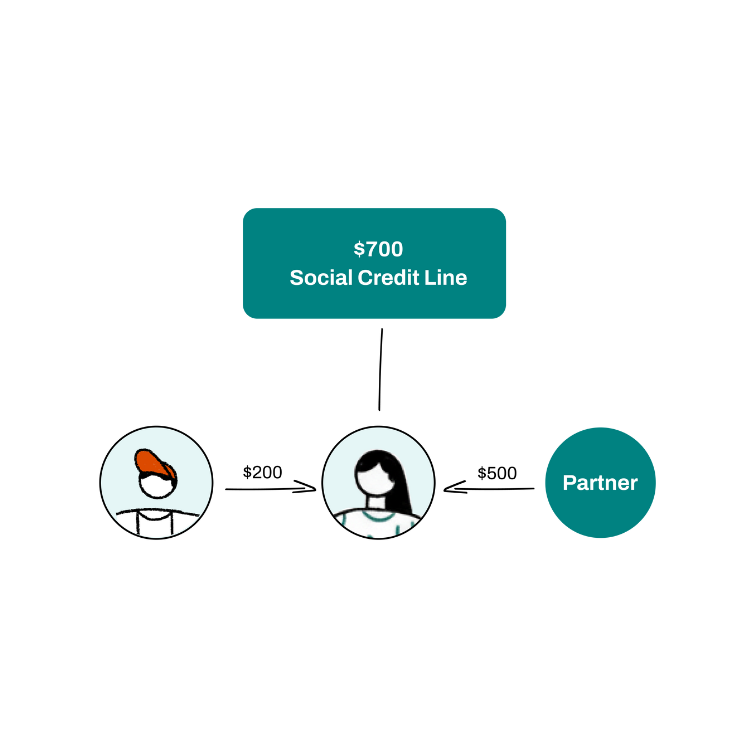

0% Interest Loan Fund

Alongside their peers, extend a social credit line and provide 0% interest loans directly to your employees or members.

Cash Transfer Fund

Provide a direct cash transfer to your clients and members to meet their financial needs and helping them avoid high cost debt alternatives

Current Partners